Russia, Iran Will Have To Adopt Bitcoin – Bitcoin Magazine

That is an opinion editorial by Q Ghaemi, a shares and bitcoin analyst and writer of the Qweekly Replace e-newsletter.

Earlier this month, reviews surfaced that the Central Financial institution of Iran is working with the Russian Affiliation Of The Crypto Trade And Blockchain to create a stablecoin that will likely be backed by gold to settle commerce. This isn’t the primary foray into the crypto universe for both nation, nor will it’s the final. However this enterprise will come to nothing, finally bringing each nations one step nearer to adopting Bitcoin.

Iran’s Foray Into Cryptocurrencies Favor Bitcoin

In August 2022, a headline got here and went and most didn’t hear about it, and people who did gave it little thought: “Iran Approves Use Of Cryptocurrency For Imports To Bust Sanctions.” Ignoring the truth that the supply for this headline was a Saudi-funded media outlet with the possible aim of destabilizing and delegitimizing Iran, you will need to acknowledge that Iran efficiently accomplished a commerce in August with an estimated worth of $10 million, which might be assumed to have been performed in bitcoin.

Primarily based on day by day quantity, there are about 20 attainable cryptocurrencies that might have been used to finish this transaction, nevertheless, if we take these cryptocurrencies by day by day quantity and agree that none with a day by day quantity lower than $1 billion may have presumably been used (something higher than 1% of day by day quantity would transfer the value too considerably: 1% of $1 billion is $10 million) we’re left with seven attainable cryptocurrencies: Ripple (XRP), Solana (SOL), USDC, Ethereum (ETH), Binance (BNB), Tether (USDT) and Bitcoin (BTC).

We are able to rapidly remove USDC, Solana and Ripple as a result of they’re all run by U.S. firms and, because of sanction legal guidelines (see: Twister Money), they’d be compelled to forestall Iran from utilizing their platform (additionally it’s secure to imagine that the Iranian authorities selected to keep away from U.S. corporations for simplicity’s sake). Tether can be thrown out given its hyperlink to the U.S. greenback. I may also throw out Ethereum as a result of Iranians are too low-cost to pay these fuel charges. This leaves us with two choices: BNB and Bitcoin. Private bias apart, nobody is settling worldwide commerce with BNB with out Binance CEO Changpeng Zhao (CZ) taking some type of a victory lap. Bitcoin wins.

Iran additionally beforehand banned Bitcoin mining operations because of stress on Tehran’s energy grid. It has since returned the entire mining tools and, as famous above, made the declare that $10 million in worldwide commerce was accomplished utilizing cryptocurrency. Suffice to say, Iran has begun to see the potential of Bitcoin.

Russian Foray Into Cryptocurrencies Demonstrates Want For Unsanctioned Alternate

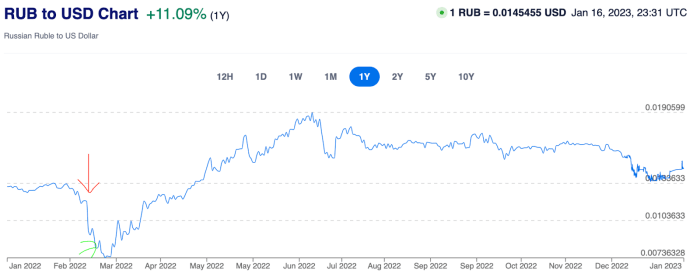

Russia has additionally begun to dip its toes within the broader cryptocurrency area. After the U.S. authorities responded to the invasion of Ukraine with sanctions, Russia was compelled to discover alternate options to finishing worldwide commerce. President Vladimir Putin’s response was to forgo the over $500 billion in its reserves and mandate that each purchaser of Russian pure fuel pay in Russian rubles. The ruble responded very positively to this information (see the chart under with a crimson arrow pointing to when U.S. sanctions started and a inexperienced arrow pointing to when the ruble turned the one cost for Russian pure fuel).

Supply

Russia then slowly started to reverse its 2020 place on cryptocurrencies. Late final yr, Russia introduced that it’ll enable worldwide settlement in cryptocurrencies with none restrictions, an enormous reversal from its earlier stance. These strikes show that Russia sees the potential for cryptocurrencies as a medium of change.

Sanctions Make The Bond Stronger

Each nations have been on the receiving finish of U.S./Western sanctions however have discovered methods to navigate round them to stay in energy. The lesson that each of those nations have realized is to belief nobody, particularly on this planet of funds. Putin profusely introduced that by freezing Russia’s greenback holdings, it “virtually defaulted,” signaling that even the mighty greenback might not be as mighty because the U.S. needs you to consider.

Iran can be no stranger to the empty guarantees of the West: after negotiating and agreeing to a nuclear deal in 2015, President Donald Trump got here in and tore up the outdated settlement. Whereas this can be frequent apply in some (shady) enterprise ventures, that is an insult in Persian tradition. Each indication {that a} new nuclear deal will likely be signed by Iran was laughable: why would Iran assume the subsequent deal could be upheld after this president left workplace? For sure, the Iranian authorities has little or no belief of international governments.

“The enemy of my enemy is my pal” plus “hold your mates shut however your enemies nearer” equals Iran/Russia relations.

In 2023, it virtually is sensible to Westerners that Russia and Iran would work collectively. Each nations are deemed villains by many Western nations, and strict sanctions stop them each from promoting their assets to the world. Each have stockpiles of oil and fuel that the world desperately wants. And but, their historical past is way from harmonious.

Till the Twenties, each the U.Ok. and Russia fought over management of the assets of Iran. The Qajar dynasty would bend the knee and provides something international powers requested in change for wealth and riches for its household. This all modified after the 1921 coup introduced an finish to the Qajar dynasty and dropped at energy Reza Shah.

Reza Shah refused to provide concessions to international powers and targeted on rising Iran. The Soviet Union got here to be one yr later, which triggered the united states to concentrate on home development as effectively. As Iran started to develop in significance to the West (mainly to the U.Ok. and the U.S.), Reza Shah and his son (the final Shah of Iran, Mohammad Reza Shah), would use the West’s worry of communism to their benefit. If Iran wouldn’t get what it wished from its Western commerce companions, it could go make a small take care of the united states to remind them who was in cost.

Regardless of the as soon as contentious historical past between these two nations, it looks as if they’ve discovered a typical floor: notion as an enemy of the West.

Why The New Stablecoin Will Fail

I made a lofty declare that the stablecoin experiment between Iran and Russia will fail and trigger them to undertake Bitcoin. How will it fail? There isn’t any belief: there by no means was and there by no means will likely be.

Belief might be eroded whereas the community is being fashioned. Whereas many Russian and Iranian leaders could consider that their nations’ prime engineers can craft a product that is ready to circumvent any adversarial assaults, what’s to cease the opposite nation from giving themselves backdoor entry? What’s stopping somebody from making a solution to double spend tokens? Now, that is all conjecture: I’m presenting only a handful of potential flaws on this system — what number of extra are you able to consider?

The biggest query is concerning the gold reserves backing the stablecoin: The place will the gold be saved and who will confirm that the quantity of gold listed continues to be there? Given the dearth of belief, neither nation might be anticipated to blindly settle for that the opposite is holding the quantity of gold it claims to be (see “The Bitcoin Customary” for extra on this matter), and sanctions stop a good third celebration from getting concerned (though China may match into the puzzle in a roundabout way right here).

As this very massive and crucial hurdle is met, one other query will proceed to loom: Why? Why do we have to do any of this when there’s a cryptocurrency on the market with sufficient liquidity to suffice their wants and that requires no belief in both celebration?

Each Iran and Russia have banned residents from utilizing Bitcoin, however they’ve additionally reversed a few of their positions over time. It’s secure to say that each governments are nonetheless within the means of understanding the facility and scope of what cryptocurrencies have to supply. It is usually value noting that, ought to this joint effort achieve success, it is not going to be the primary gold-backed cryptocurrency.

Conclusion

Each nations are nonetheless within the information-gathering stage and, if by some miracle, a researcher stumbles throughout this text, let me spell it out plain and easy: Historical past has confirmed that when given the chance to manage cash, the individuals in cost will manipulate the cash for his or her profit.

There’s a cause the Roman Empire fell and that we don’t use guilders or kilos as international currencies. As a substitute of bringing this temptation into the equation, adopting a trustless type of cash that can’t be manipulated or inflated is the one answer. Bitcoin is the inevitable cash you’re in search of. Whether or not you get there earlier than your enemies is as much as you.

It is a visitor submit by Q Ghaemi. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

Source link